After a two-year-long run that saw them dominate market gains, the “Magnificent Seven” tech stocks—comprising Nvidia, Apple, Microsoft, Amazon, Alphabet, Meta, and Tesla—are showing clear signs of fatigue. A recent market rotation, driven by overvaluation concerns and a disappointing AI product launch, has seen investors shift capital from the tech giants toward more traditional sectors like energy, materials, and real estate. This change in sentiment signals a potential rebalancing of the U.S. stock market.

The primary trigger for the investor shift appears to be a combination of factors. First, many analysts believe the valuations of these tech companies have become stretched, with share prices detached from underlying fundamentals. For example, Nvidia, once the poster child of the AI boom, has seen its stock valuation questioned amidst rising competition from cheaper Chinese AI technologies.

Adding to the skepticism is the recent launch of OpenAI’s GPT-5 model. Billed as a “major step forward,” the release was met with disappointment from users and developers who found that the new model, while excelling in benchmarks, still struggles with “hallucinations” and inconsistent performance in real-world applications. This underwhelming debut has led to a sense of “AI hype fatigue”, with investors questioning whether the massive spending on AI infrastructure will yield commensurate returns in the near term.

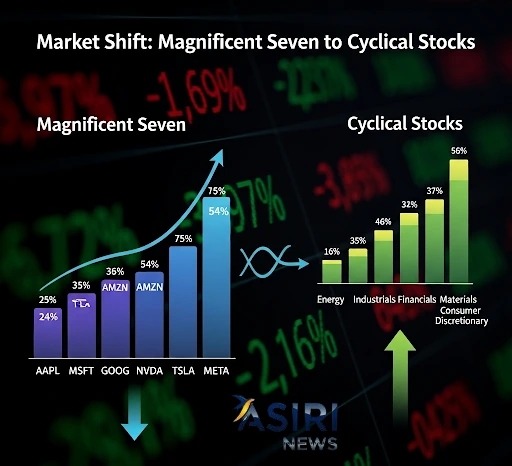

In the past week, the Nasdaq Composite, a tech-heavy index, has fallen by more than 1.5%, with individual tech stocks like Meta, Nvidia, and Apple seeing declines. In contrast, sectors that stand to benefit from a rate-cut environment—such as real estate, materials, and energy—have rallied, with the real estate sector, in particular, gaining over 2% last week.

This rotation is a direct reflection of investor expectations for a softening economy. Investors are moving away from the high-growth, high-risk tech sector and into more stable, economically sensitive sectors. These “cyclical” stocks tend to perform well when the economy reaccelerates, as anticipated with the Federal Reserve’s potential interest rate cuts. This marks a significant change from the market concentration of recent years and suggests that diversification is once again becoming a key strategy for investors.