Central bankers from around the world convened at the annual Jackson Hole symposium, where the shadow of American politics loomed large over the discussions. The key theme of concern was the erosion of central bank independence, with many international finance leaders expressing alarm over the escalating political pressure being applied to the U.S. Federal Reserve.

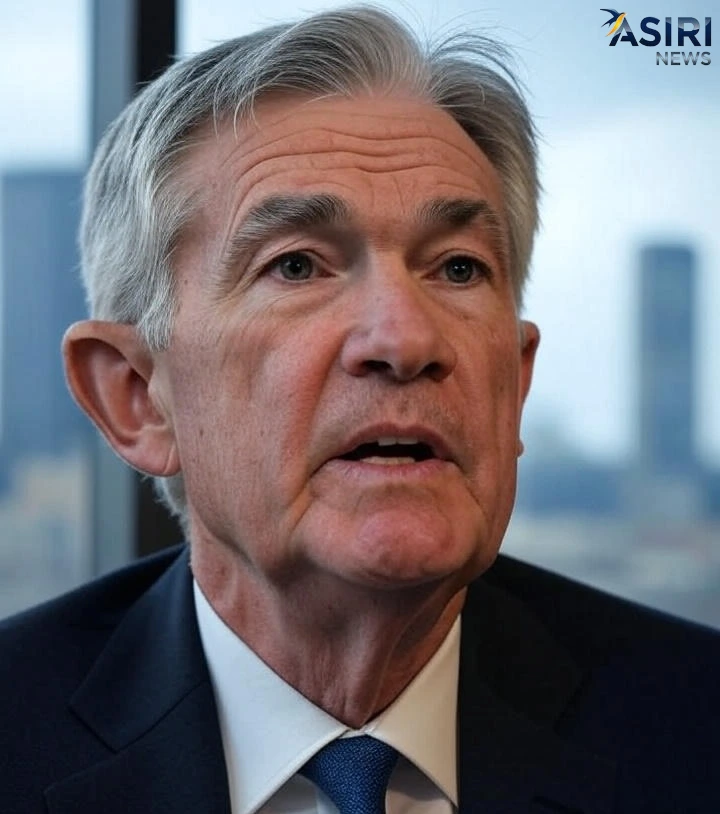

The consensus view among attendees was that President Donald Trump’s repeated public attacks on Fed Chair Jerome Powell and his administration’s attempts to influence monetary policy could set a dangerous global precedent. The fear is that if the world’s most powerful central bank is seen to yield to political demands, it would embolden politicians in other countries to do the same, threatening the stability and integrity of the global financial system.

Prominent figures at the event, including European Central Bank (ECB) policymaker Olli Rehn and Bundesbank President Joachim Nagel, underscored the importance of central bank autonomy. They argued that independence is a “conditio sine qua non”—an essential condition—for maintaining price stability. They noted that a politicized central bank might be forced to keep interest rates artificially low to stimulate short-term growth, a move that could ultimately lead to uncontrolled inflation, as witnessed in the United States during the 1970s.

The current tensions arise from President Trump’s demand for the Fed to slash interest rates to spur economic growth, a position that clashes with the central bank’s mandate to control inflation and maximize employment. Trump has gone further than past presidents by publicly criticizing Powell and even calling for his resignation. While the Supreme Court has indicated a president cannot fire a Fed chair for policy disagreements, the intense public pressure and legal maneuvering have created a climate of uncertainty.

The potential consequences of a loss of Fed independence are far-reaching. Central bankers warned that it could cause turmoil in financial markets, as investors lose confidence in the U.S. economy’s ability to maintain a stable currency. This could lead to a reassessment of the U.S. dollar’s status as the lifeblood of the global financial system and a shift away from U.S. Treasury securities, which serve as a benchmark for government and corporate debt worldwide. For now, financial markets have not shown deep concern, with U.S. equity markets remaining strong. However, the discussions at Jackson Hole serve as a clear warning that the established norms of monetary policy are more fragile than previously thought and should not be taken for granted.