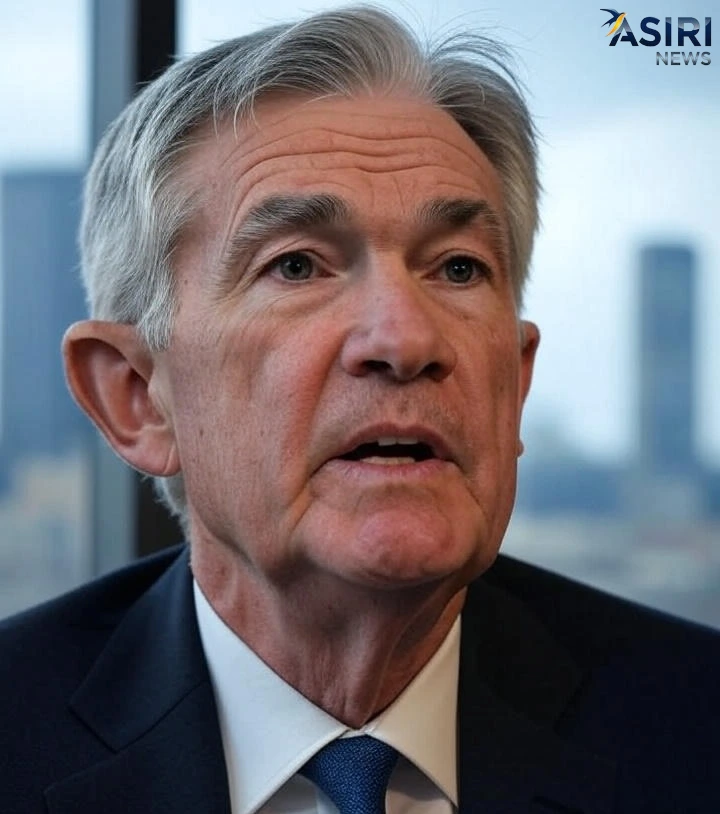

In a highly anticipated address at the annual Jackson Hole symposium, Federal Reserve Chair Jerome Powell gave the strongest signal yet that the central bank is prepared to cut interest rates at its upcoming meeting in September. Powell’s remarks were carefully balanced, acknowledging both a “curious kind of balance” in the labor market and the persistence of inflationary risks. However, markets interpreted his tone as decisively “dovish,” leading to a significant rally in stocks and bonds.

Powell pointed to a weakening labor market as a key reason for a potential policy shift. While the unemployment rate remains relatively low at 4.2%, other indicators, such as a sharp slowdown in job growth—with only 73,000 jobs added in July—suggest a cooling economy. Powell warned that the risks of a serious job market downturn are rising and that “if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.”

Despite the focus on employment, Powell was also clear that the Fed’s other mandate—maintaining stable prices—is still a priority. The latest Consumer Price Index (CPI) data showed inflation at 2.7%, still above the Fed’s 2% target. However, this figure is a significant drop from the 9.1% peak reached in June 2022. Powell noted that the economy is facing “new challenges” from President Trump’s tariffs, which are pushing up prices and creating uncertainty.

The market’s reaction was swift and positive. All three major U.S. stock indexes—the S&P 500, Dow Jones, and NASDAQ—posted strong gains. According to the CME Group’s FedWatch Tool, investors are now pricing in a more than 90% chance of a September rate cut. In the bond market, the 10-year Treasury yield dropped, reflecting growing optimism about future rate reductions. The prospect of lower borrowing costs has also boosted sectors sensitive to interest rates, such as home construction and small-cap companies.

For now, financial markets appear to have discounted the nuance in Powell’s speech, focusing on the strong probability of a rate cut. The September Federal Open Market Committee meeting will be a crucial moment, as it will determine whether the Fed will follow through on Powell’s hint and embark on a new round of monetary easing to support the economy.